Contents

FOREX CANDLESTICKS MADE EASY

Candlestick made easy is a distilled, concentrated pdf that contains vital information that you can use to maximize your profits. The pdf comes with step by step illustrations that show you how precisely to determine the most appropriate time to enter and exit the market.

The pdf will help you to know whether the market is going to reverse or merely going through a temporary correction. You will also be tight the two most serious mistakes that retailers make, and the mitigating strategies to avoid the money traps will also know that two identical candlesticks can inform you two completely different prices of information about the market.

Candlestick patterns

Although the components of a candlestick are the bones of the charting, the patterns the candlestick are the heart and soul of the chart. Models will appear on the chart as:

- Simple, single stick appearances

- Complex, multi-stack patterns.

The candlestick patterns are fundamental in indicating when the present trends reverse or when they are likely to continue. The two types of models are important because they inform you when to get into a transaction and when to exit out of a trade when an operation that you are already in may not be profitable and when to stick to a business that you are already in.

Making the technical analysis of a candlestick.

An enormous amount of mathematical intellect is utilized when dealing with security trade. The options for technical analysis can be as easy as calculating the average of the closing prices of some days or as complex as using calculus to price action to determine the momentum of the prices.

The possibilities are innumerable. Do not hesitate to include some of the technical aspects that you prefer to use in your trading strategies besides the candlestick charts. Take your time and familiarize yourself with different types of technical indicators to make yourself more knowledgeable and enrich your business with candlestick charts.

For instance, you could identify a candlestick pattern that tells you that it is time to purchase and at the same time your favorite technical signal is flashing a buy signal. When you can combine various trading tools, you will have more confidence, and you will be more able to decide when a trade is going to succeed. Ability to apply technical analysis will also help you to exit with minimal losses when exiting is inevitable.

Know your candlestick charts

This module explores the benefits of candlestick charts. Candlestick chart is a unique variant of chart information that has been in existence for more than three centuries now. Compared to other conventional charts, candlestick charts unfold more details that you could ever get from other regular charts.

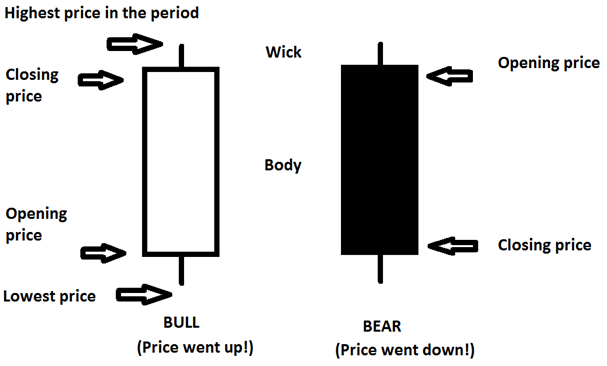

- A candlestick is a vertical line that forecasts the trading range for a particular time. The wider bar in the candlestick chart is a representation of the difference between the opening and the closing rate of a pair of currencies for a given duration of time.

- Hence, daily candlesticks stand for the opening, closing, intraday high and low for a particular pair of currencies that you wish to analyses for a given day. The wider regions referred to as the real body of the candlestick. The body shows the rage that the pair of currency traded through the day from the time dawn to dusk.

- In case the currency pair closed lower that the rate at which it opened, the actual body of the candlestick appears black, red or filed in. The opposite will happen when the end is noted to be higher than the closing rate. In this case, the real body is not filled invite remains empty or it is green.

Origin of candlestick charts

The candlestick technique has its roots in Japan. The Japanese traders were using the technology more than 100 years ago. It was discovered by the Japanese by the name of Homma Munehisa who identified the essential link between the price and supply-demand and the ratio of the amount of rice. He also realized that a trader’s emotion had an indication of the move of the price.

Homma realized that sometimes the difference between the actual trading rate and the value of rice was as a result of the emotions of the trader. These observations became the foundation of the candlestick chart. The candlestick was later modified with the bar being introduced.

Components of the candlestick

The candlestick illustrates the opening, closing and intraday range of a given currency trident vast body informs you of the whole day’s trading activity inclusive of the indication of the high and the low points. A filled in candlestick reveals a lower closing as compared to the opening while an empty area reveals a higher end as compared to the opening.

The shadows

The shadows are considered by many traders the wick of the candlestick. The shadows are formulated after the trader has plotted the session’s trading activities. If the upper body of the candlestick above the filled body is short, the indication is that the opening of a certain session for a particular pair of currencies was high at the end of the day.

A long empty on the other hand indicates a continuous bullish period, and a long filled body is vice versa. Different types of candlestick forms show an exceptional condition in the market. For instance:

- A spinning top shows a tight intraday range open and reveals neutral bias in the market.

- A Jodi refers to a particular period when the opening and the closing prices of the pair of currency stays around the same range, or they remain the same.

Therefore, a candlestick does more that jostling you about the opening and closing prices and how far up or down the prices went. It informs you how the buyers or the Bulls made a decision to push the prices up and how the sellers (bears) counter-attacked and pulled the prices down.

It reveals to you which party will control the opening prices the following day, whether the other party will resist or give in ad left the other party to continue dominating.

NOTE: Each aspect of trade: opening, closing, intraday high and low all work in tandem to determine the final appearance of the candlestick.

Candlestick vs. bar graph

The two charts have remarkable distinctions:

- The barograph places more emphasis on a particular day’s closing price about the previous day’s closing

- The candlestick, on the other hand, concentrated on a single day and compares the currencies opening and closing price.

- In the candlestick, a change of color of the real body results to ease of identification of the trend.

- The barograph has its foundation in the west while the candlestick has its foundation in Japan and Asia.

- The candlestick like earlier stated originated from analyzing how the mood of the trade influenced the price of the goods. In the same e way, candlesticks in the modern-day market help the traders to determine how the atmosphere of the market, the sentiments, and emotions in the environment drive the movement of prices.

The window of time to make a decision in forex trading is very limited. Therefore, the trader must have the correct understanding pdf the direction of the trade. If the comprehension of the operator is limited or incorrect, the radar will potentially make huge losses in no time.

The candlestick may not be perfectly accurate in predicting the forex trends, but t gives the trader an important insight that helps him to track the prices of products in the forex market in one go, helping them to optimize their returns.

Advantages of candlestick charts

- The candlestick charts are easy and fun to use

- For a trader who is inexperienced, candlesticks charts will give him a deeper understanding of price movement since they are visual and they give the operators a clear view of how open, high, low and close of the candle relate.

- The information in the candlestick will generate further trading signals as compared to the traditional bar chart. It, therefore, gives the trader much more options as he seeks to create trades from charts.

- Candlesticks charts are flexible and they can either be used alone or in combination with other market indicators and technical analysis tools such as:

- Moving Averages

- Momentum oscillators

- Methods of trading like Dow Theory, Elliot Wave theory.

- The candlestick charts are easy to learn, and all the information you would need to understand them is readily available on the internet. They are very applicable. Many brokers will be using this tactic on their charting platforms.

Limitations of candlesticks

The candlestick charts are subjective. They do not tell a universal story. The trader is faced with the responsibility of interpreting the chart and applies their interpretation to generate the trading signals that they need.

You cannot use the candlestick charts to create price tags. However, you can use other market indicators and tactics to enable you to generate targets or only use additional candlestick chart information.

Building a base of candlestick chart knowledge

To benefit optimally from the candlestick charts, you must not only understand the building blocks of the charts but also learn the additional information in the charts as well as know how they age constructed. You needed to know:

- The essential pieces of information that are used to generate a candlestick

- The various additional pieces of information that you will need for your candlestick chart.

- Figure out the extra pieces of data that you can add to your chart to make it more accurate.

Know the components of the candlestick charts.

- You must fully comprehend all the parts of the candlestick before you devein to make any meaningful interpretations and put your candlestick into use. This module is designed to give you all the necessary information on the candlestick chart. You will:

- Learn all the data that goes into the building of a candlestick chart.

- You will also be taught the other extra information that you will need to include in the chart to strengthen its readability and usefulness in the trade.

- Additional information on the candlestick

- On top of all the necessary information that you find in the chart, most chats will take many other pieces of information. This extra information will allow you to analyze how the currency has reformed in the past and also gives you insights to enable you to comprehend the currency. You will know the importance of data such as:

- Date of earnings releases

- Dividends payment

- This pdf will give you an insight into all other additional pieces of information that you can expect to see on a candlestick.

The web as a resource

The internet has greatly influenced forex trading in the recent past. This pdf will give you some reliable websites where you can view the candlestick charts. The sites will show you:

- How to create the candlestick chart

- The other features that you can add to your chart.

The sites that you will find in the pdf are very resourceful. They will give you free charts and a lot of extra information concerning the candlestick charts that will empower you to make better trading and investing decisions.

Trading candlestick charts

This module of the program will show you the various features of a candlestick chart and their interpretations:

- A Jodi pattern would refer to indecision in the previous direction

- A dark cloud would signify the end of a trend

- A piercing line would suggest an imminent reversal of the trend

- An inverted hammer at the top of the chart may indicate the end of an uptrend followed by a downtrend.

This module of the eBook is aimed at showing you how the extra pieces of information in the chart can help you to interpret the chart.

Other content in the pdf includes:

- Candlestick chart patterns

- Basics of working with candlestick patterns.

- Candlestick charts and top reversal patterns.

- Shorting with RSI and bearish candlestick patterns.

- Combining moving averages and bullish trends.

- Combining technical indicators and bearish trending candlestick patterns.

- Putting trend lines together with bearish trending candlestick patterns for selling and confirmation

- Generating candlestick charts on CNBCcom

- inserting a moving average to your excel candlestick chart

- PIP range bar or candlestick charts. Reasons why the candlestick charts are so popular.

- Fibonacci retracement 618 percent and candlestick patterns.

- Creating candlestick charts on big charts come.

- The bearish squeeze alert pattern.

- The bullish squeeze pattern.

- Combine patterns and indicators.

- Points and confirm trends.

- Finding the data for your candlestick chart.

- Simple patterns.

- Intricate patterns

- Using the nans.

- Perfect market for technical analysis.

The pdf is perfect for an individual who is starting out in the forex trade so that they do not go in blindly. They will get a ton of information that will help them not only to understand the trade but also to make the appropriate predictions.

Pros

• Think of this as a manual that will teach you what to do when you are faced with the dilemma of which trend is right and which one is not so right in the indicators and it does show you what you need to know.

• The candlestick made easy is a PDF format manual that will show you what you need to do to make sure that when you are using these platforms that show you when to make a trade and when to exit.

• The manual is so easy to understand as it has been arranged in a manner that is targeted at basically the average reader who will have no problem grasping the concepts that are explained in it.

• When you are inexperienced, you will need to use the candlesticks to make sure that you have the edge that you need to make the returns of your trades even more awesome and that is what making money is all about.

• These charts have the ability to be standalone tools or you can mash them up with everything else that you have to make the best trades that you need to for optimum gains.

• The information that you will need on candlesticks is available on the internet and that will help you understand what they are about even better which will be good for the decisions that you make.

• When you compare them to the traditional bar charts that have been in use for quite a while, you will find that they are more accurate, and even more signals will be generated when you use them and that means more trades.

Cons

• The candlesticks are specific to certain grounds of operations and they are not applied in a universal or blanket way which means that you have to apply them to your situation.

Reviews

- Many reviews indicated that the book was helpful. Another author up lauded the book especially because the creator has updated the book severally since it was released. This is an indication that the author is passionate about the candlestick charts and he is also interested in helping his customers to improve their trade.

- Another review indicated that some of the information in the eBook cannot be found anywhere else. The book is therefore clearly not a scam. Another review showed that the eBook improved his trade and he emphasized that there is no way that the program is a scam.

- If the reviews are to be trusted, the program is worth your money, and when you buy it, it will be money well invested. You need to buy the eBook especially if you are interested in forex trading.

The pdf really helped me to know whether the market is going to reverse or merely going through a temporary correction. The options for technical analysis is as easy as calculating the average of the closing prices of some days or as complex as using calculus to price action to determine the momentum of the prices.Candlestick made easy is a distilled.it is helping us in many ways.

I am a beginner trade in this field of forex. Therefore no much experience in the field. I am however very happy that with such persons, I am able to make things happen in a better way. I will keep earning even more as time goes by.

It gives some great insight that I haven’t read anywhere else. I’ve come to the conclusion that there is no single source for candlestick training.

This is an amazing guide so quick and easy to read! The pieces of advice are simple and effective, I think even the beginners will find a lot there.

I’ve come to the conclusion that there is no single source for candlestick training. If you decide to buy it, get it!

It is not meant for everybody but if it could be meant for you Forex trading made easy is your best bet.

The candlesticks offer useful information to all people who are engaged with Forex trading. In other words, you will be able to figure out whether price would end up at a higher value or a lower value at the closing time, when compared to the opening time.

I’ve come to the conclusion that there is no single source for candlestick training. If you decide to buy it, get it from the original author so he gets a little something for his hard work.